when will i get my mn unemployment tax refund

If I paid taxes on unemployment benefits will I get a refund. Tips for Using the Wheres My Refund.

Irs Offset Intent To Offset Tax Refunds Help Community Tax

Why havent I received my federal tax refund.

. The 10200 is the amount of income exclusion for single filers not the amount of the refund. We will mail a paper copy of your 1099-G to the address we had on file for you on December 31 2021. Therefore if you received unemployment income in 2020 and paid tax on that.

The website also states that they sent letters to taxpayers that need to amend their state return. Additional Assessment for 2022 from 1400 to 000. Ad Learn How To Track Your Federal Tax Refund And Find The Status Of Your Direct Deposit.

How to calculate your unemployment benefits tax refund. As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month. Your tax return has errors.

They have about 540000 refunds to issue and expect to do 1000 per week so it may take a while. Recipients may not get a tax break this year which means they should take. Dont file a second tax return.

Meanwhile households who receive the cash refund by paper check could expect this from July 16. We will start to mail out 1099-Gs in mid-January and will complete all mailings by January 31 2022. It is too late to change your address for the 1099-G.

When is the information updated. As a result jobless benefits up to 10200 for individuals earning less than 150000 per year are exempt from tax. Contact Info Email Contact form Phone 651-296-4444 800-657-3676.

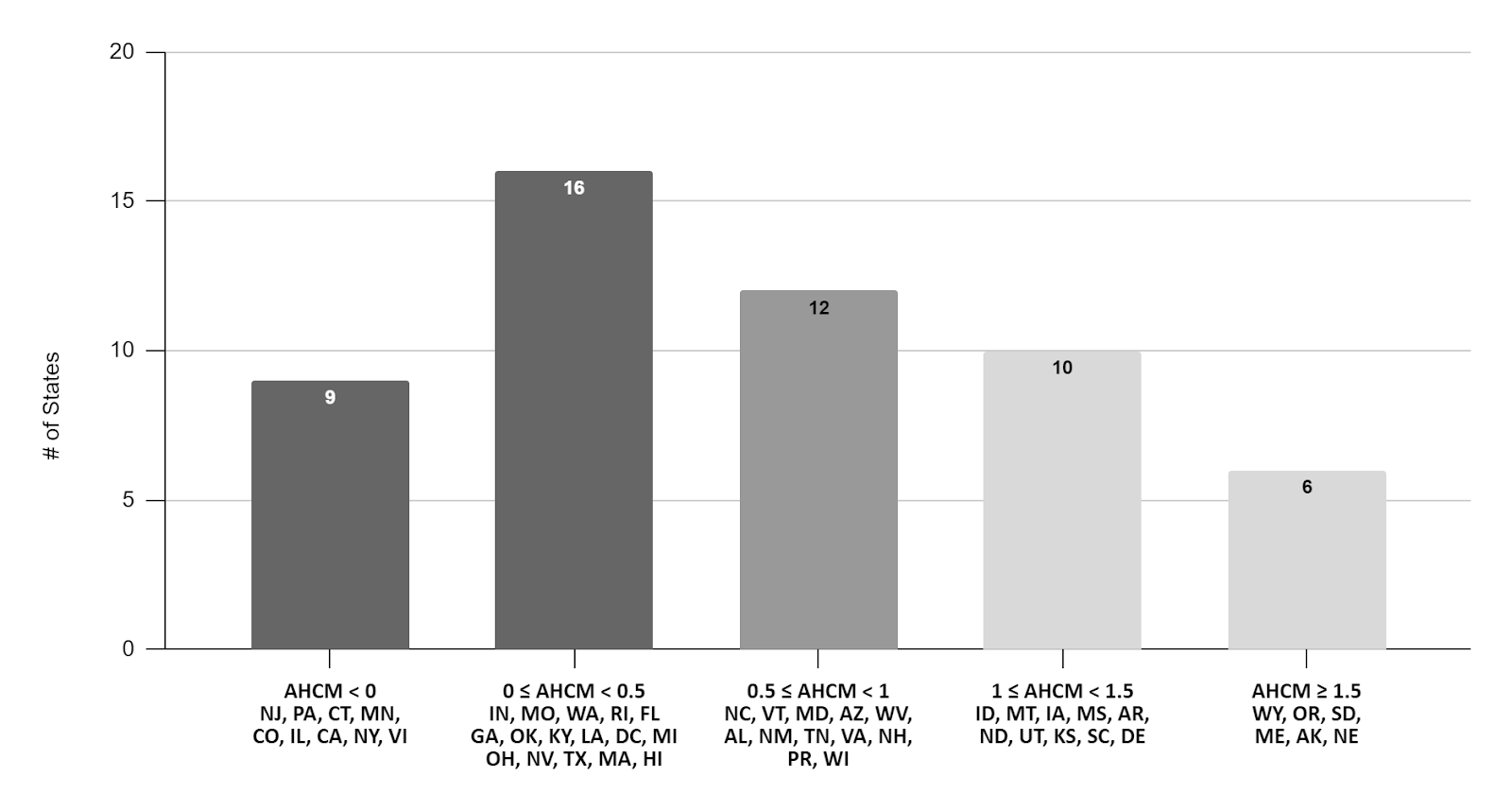

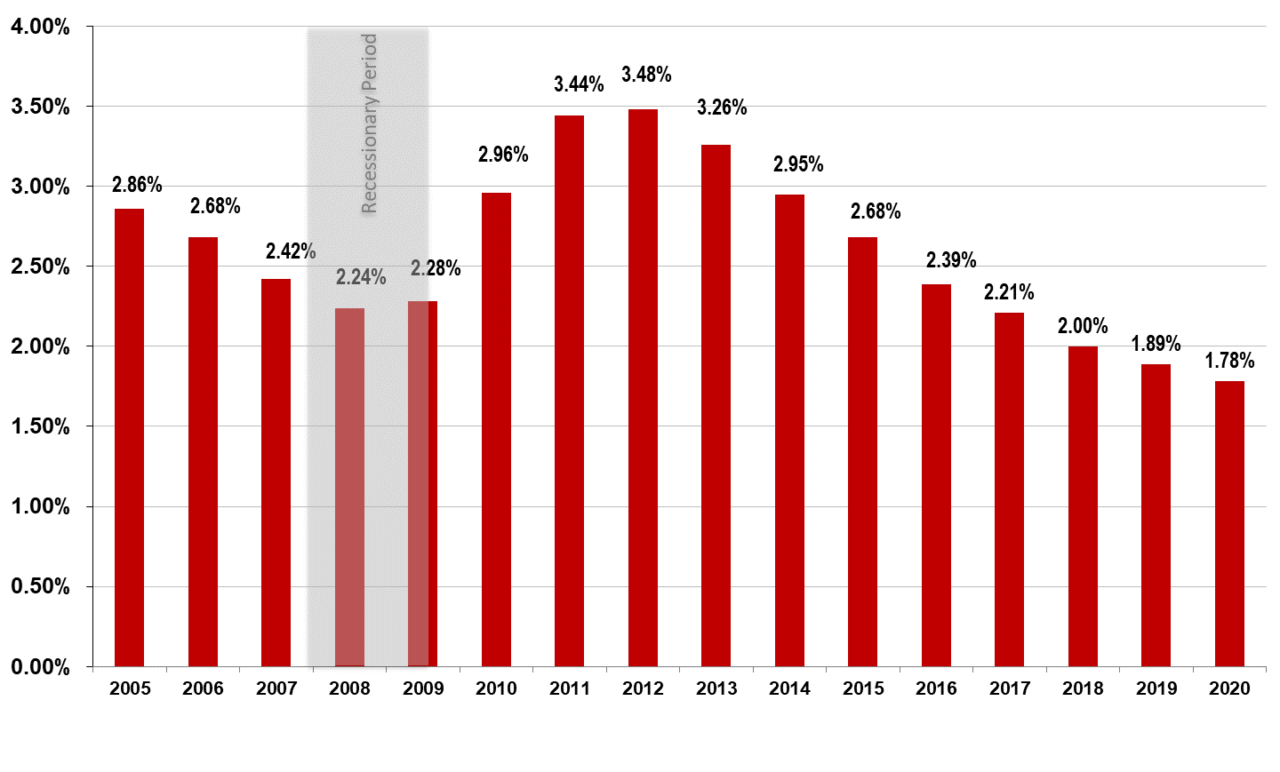

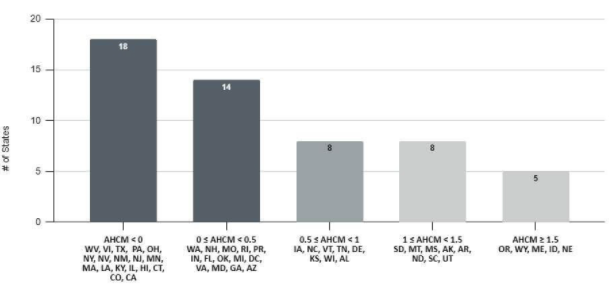

Base Tax Rate for 2022 from 050 to 010. PAUL WCCO -- Businesses that received forgivable payroll loans from the federal government and Minnesotans who got extra jobless benefits last year will begin seeing state tax refunds in the. For details see Direct Deposit.

Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Your return needs further review. If you dont receive your refund in 21 days your tax return might need further review.

If you enter an account that exceeds this limit well send your refund as a paper check. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a. The first phase included the simplest returns made by single taxpayers who didnt claim for children or any refundable tax credits.

You filed for the earned income tax credit or additional child tax credit. If you received unemployment benefits in 2020 a tax refund may be on its way to you The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said.

Unemployment tax refunds started landing in bank accounts in May and ran through the summer as the IRS processed the returns. Its taking us more than 21 days and up to 120 days to issue refunds for tax returns with the Recovery Rebate Credit Earned Income Tax Credit and Additional Child Tax Credit. The new law reduces the.

Heres a list of reasons your income tax refund might be delayed. The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill. What can slow down my refund.

In mid-July the IRS issued 4million refunds of which those by direct deposit landed in bank accounts from July 14. Another batch of payments were then sent out at the end of July with direct deposits on July 28 and paper checks on July 30. System When can I expect my refund.

Without that law Minnesota businesses were set to suffer a 30 increase in their unemployment taxes triggered when the fund is below a certain threshold. If youre due a refund from your tax return you should wait to get it before filing Form 1040-X to amend your original tax return. More complicated ones took longer to process.

The amount of the refund will vary per person depending on overall income tax bracket and how. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022.

You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946. State lawmakers managed to pass the law the day before the April 30 deadline to submit taxes but alas some businesses had already paid their quarterly taxes at the higher rate.

Surprise Checks Of 584 Going Out To More Than 500 000 Households Before New Year S Eve Do You Qualify

State Income Tax Returns And Unemployment Compensation

Mn Has A Record Budget Surplus How Should Lawmakers Cut Taxes

Taxact Review 2022 Pros Cons And Who Should Use It

State Income Tax Returns And Unemployment Compensation

Child Tax Credit 39m Families Get Monthly Payments Starting July Kare11 Com

Ppp Ui Tax Refunds Start In Minnesota

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

View All Hr Employment Solutions Blogs Workforce Wise Blog

Minnesota Lawmakers Finish Deal On Unemployment Bonuses Mpr News

View All Hr Employment Solutions Blogs Workforce Wise Blog

How To Check The Status Of Your Tax Return Get Transcripts Tfx User Guide